The proliferation of mobile phones and other technologies in all regions of the world provides a unique opportunity to use large-scale digital data for social good. By developing a set of methods for understanding social and economic behavior in developing countries, work at the DataLab is helping to promote effective public policy for alleviating poverty and producing positive social change.

Current Projects

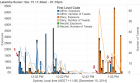

This research seeks both to understand the patterns and mechanisms of the diffusion of misinformation on social media and to develop algorithms to automatically detect misinformation as events unfold. During natural disasters and other hazard events, individuals increasingly utilize social media to disseminate, search for and curate event-related information. There is great potential for this information to be used by affected communities and emergency responders to enhance situational awareness and improve decision-making, facilitating response activities and potentially saving lives. Yet several challenges remain; one is the generation and propagation of misinformation. Taking a novel and transformative approach, this project aims to utilize the collective intelligence of the crowd – the crowdwork of some social media users who challenge and correct questionable information – to distinguish misinformation and aid in its detection.

We present the results of a field experiment in Afghanistan that was designed to increase adoption of mobile money, and determine if such adoption led to measurable changes in the lives of the adopters. The intervention we evaluate is a mobile salary payment program, in which a random subset of individuals of a large firm were transitioned into receiving their regular salaries in mobile money rather than in cash. While mobile money salaries led to immediate and significant cost savings to the employer, we find little consistent evidence that mobile money had an impact on several key indicators of individual wealth or well-being. Taken together, these results suggest that while mobile salary payments may greatly increase the efficiency and transparency of traditional economies, in the short run the benefits may be realized by those making the payments, rather than by those receiving them.

Informal exchange of information occurs continually throughout daily life. These pre-existing communication patterns are vital during non-routine circumstances such as emergencies and disasters. In recent years, informal communication channels have been transformed by the widespread adoption of social media technologies and mobile devices. Although the potential to exploit this capacity for disaster response is increasingly recognized by practitioners, relatively little is known about the dynamics of informal online communication in response to exogenous hazard events. To address this gap, this project employs a longitudinal and comparative approach to examine the content, structure, and dynamics of online communication and information exchange during emergency and disaster events.

We exploit a novel source of data to model the impact of migration and urbanization on segregation in Estonia. Analyzing the complete mobile phone records of hundreds of thousands of Estonians, we observe the ethnicity of each individual on the network (Russian or Estonian), the complete history of locations visited by each individual, and every phone-based interactions taking place over the network. We find that the ethnic composition of an individual's geographic neighborhood heavily influences the structure of the individual's phone-based network. We further find that patterns of segregation are significantly different for migrants than for the at-large population: migrants are more likely to interact with coethnics than non-migrants, but are less sensitive to the ethnic composition of their immediate neighborhood than non-migrants.

When crises occur, including natural disasters, mass casualty events, political and social protests, etc., we observe potentially drastic changes in social behavior. Local citizens, emergency responders and aid organizations flock to the physical location of the event. Global onlookers turn to communication and information exchange platforms to seek and disseminate event-related content. This social convergence behavior, long known to occur in offline settings in the wake of crisis events, is now mirrored – perhaps enhanced – in online settings. This project looks specifically at the mass convergence of public attention during crisis events. Viewed through the framework of social network analysis, mass convergence of attention onto individual actors can be conceptualized in terms of degree dynamics. This project employs a longitudinal study of social network structures in a prominent online social media platform to characterize instances of social convergence behavior and subsequent decay of social ties over time, across different actors types and different event types.

This research addresses empirical and conceptual questions about online rumoring, asking: (1) How do online rumors permute, branch, and otherwise evolve over the course of their lifetime? (2) How can theories of rumor spread in offline settings be extended to online interaction, and what factors (technological and behavioral) influence these dynamics, perhaps making online settings distinct environments for information flow? The dynamics of information flow are particularly salient in the context of crisis response, where social media have become an integral part of both the formal and informal communication infrastructure. Improved understanding of online rumoring could inform communication and information-gathering strategies for crisis responders, journalists, and citizens affected by disasters, leading to innovative solutions for detecting, tracking, and responding to the spread of misinformation and malicious rumors. This project has the potential to fundamentally transform both methods and theories for studying collective behavior online during disasters. Techniques developed for tracking rumors as they evolve and spread over social media will aid other researchers in addressing similar problems in other contexts.

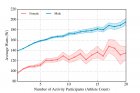

Individuals are influenced by their social networks. People adjust not only their opinions and attitudes, but also their behaviors based on both direct and indirect interaction with peers. Questions about social influence are particularly salient for activity-based behaviors; indeed much attention has been paid to promoting healthy habits through social interaction in online communities. A particularly interesting implication of peer influence in these settings is the potential for network-based interventions that utilize network processes to promote or contain certain behaviors or actions in a population; however, the first step toward designing such intervention strategies is to understand how, when, and to what extent social signals delivered via social interaction influence behavior. This project fills this gap by using digital traces of behaviors in online platforms to observe and understand how social networks and interactions are associated with behavior and behavior change.